arizona residential solar energy tax credit

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. Ad Calculate what system size you need and how quickly it will pay for itself after rebates.

Solar Tax Credit In 2021 Southface Solar Electric Az

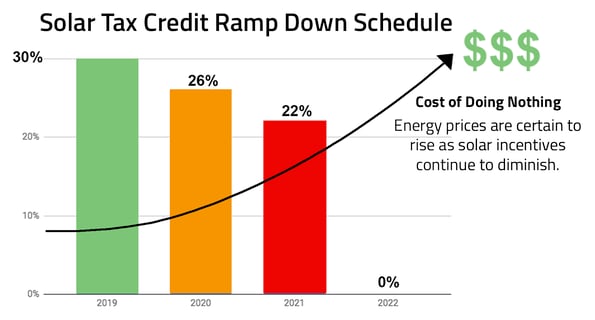

In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023.

. 41-1511 was established by the Arizona. Application for Approval of Renewable Energy Production Tax Credit Note. Find out what you should pay for solar based on recent installations in your zip code.

The credit is allowed against the taxpayers. The tax credit remains at 30 percent of the cost of the system. First the federal government offers a solar tax credit to help you save on your solar panel purchase.

Arizona Non-Residential Solar Wind Tax Credit Personal is a State Financial Incentive. In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023. Arizona Department of Revenue tax credit.

The Renewable Energy Tax Incentive Program is not available beginning on or after January 1 2021. Compare Solar Power Quotes Today. Every resident in Arizona who installs solar.

The Renewable Energy tax credit ARS. Find The Right Solar System For You. The tax credit is equal to 10 of the installed cost of the solar energy device not to exceed 25000 in credits for one building in a single tax year and 50000 total credits per business.

This means that in 2017 you can still get a major discounted price for your. Worth 26 of the gross system cost through 2020. 1254 of 2010 created a tax credit for electricity produced by certain renewable resources.

Application for Approval of Renewable Energy Production Tax Credit. Ad Find Solar Panel Prices By Zip. Arizonas tax credit for solar and.

9 rows Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or. An Arizona law offers a solar energy credit for purchasing and installing a solar energy device at 25 percent of the cost which includes installation or 1000. Qualified renewable energy systems installed on or after December 31 2010 may be eligible.

Arizonas Solar Energy Credit provides an individual taxpayer with a credit for installing a solar or wind energy device or system at the taxpayers Arizona residence. No preapproval is required for an individual income tax credit for a residential Solar Energy Device tax credit that is claimed on Arizona Form 310. The tax credit is 26 in 2022 22 in 2023 and will disappear in 2024 if.

Ad Check Out Our Wide Variety Of Inventory From Charge Controllers To Inverters To Panels. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. Arizona Department of Revenue.

Here are the specifics. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. Shop Northern Arizona Wind Sun for Low Prices Free Ground Shipping For Orders 500.

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. The credit is allowed.

See residential Solar Energy Device tax credit that is claimed on Form 310 for solar devices. 23 rows A nonrefundable individual tax credit for an individual who installs a. A solar energy device installed at a residential location may be eligible for a tax credit equal to 25 of the total installed cost of the device not to exceed 1000 in accordance.

For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable. Arizona offers state solar tax credits -- 25 of the total system cost up to 1000.

Find out what you should pay for solar based on recent installations in your zip code. Ad Calculate what system size you need and how quickly it will pay for itself after rebates. So when youre deciding on whether or not.

The Renewable Energy Production tax credit is for a qualified energy generator that has at least 5 megawatts. Summary of solar rebates in Arizona. Arizona solar tax credit.

Solar - Passive Solar Water Heat Solar Space Heat Solar Thermal Electric Solar Thermal Process Heat Solar Photovoltaics Daylighting Solar Pool Heating.

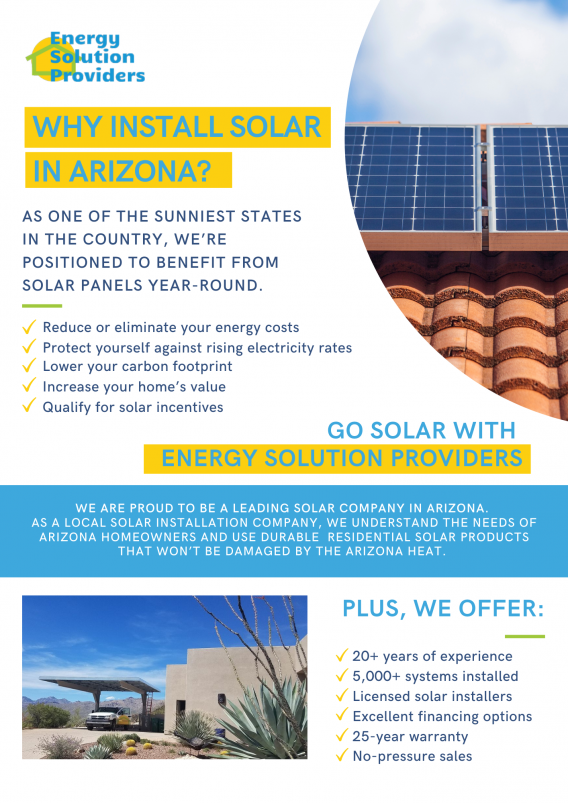

Residential Solar Panels Energy Solution Providers Az

Solar 101 Energy Solutions Providers Az

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

Free Solar Panels Arizona What S The Catch How To Get

3 Solar Incentives To Take Advantage Of Before They Re Gone

Solar Panels Cost Arizona 2022 Cost Vs Savings Calculator

Solar Tax Credit In 2021 Southface Solar Electric Az

Why 2022 Is The Year To Go Solar In Arizona Southface Solar

How To Take Advantage Of Solar Tax Credits Earth911

Is Solar In Arizona Actually Free

Why Do Arizona Homeowners Go Solar Sunsolar Solutions

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

Federal Tax Credit For Solar Panels Going Away In 2020 Solar Solution Az

Solar Tax Benefits In Phoenix Arizona Solar Incentives

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

Is Solar Worth It In Arizona Energy Report

Arizona Solar Tax Credits And Incentives Guide 2022